Turning 65 is a major milestone—congratulations! Along with celebrating this new chapter, it’s also time to think about your health coverage. Medicare, the federal health insurance program for people 65 and older, can seem complicated at first, but with the right information and a little planning, you can make confident choices that protect your health and your wallet.

Whether you’re still working, planning to retire, or already retired, here’s what you need to know and do to ensure you have the right Medicare coverage when you turn 65.

1. Understand the Basics of Medicare

Medicare is divided into different parts, each covering specific services:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, preventive services, and some home health care.

- Part C (Medicare Advantage): An alternative to Original Medicare (Parts A and B), offered by private insurance companies. These plans often include extra benefits like vision, dental, and prescription drug coverage.

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription drugs. These plans are offered by private insurers and can be added to Original Medicare.

For a detailed overview, visit the official Medicare.gov What’s Medicare? page.

2. Know Your Enrollment Periods

Timing is everything with Medicare. Missing deadlines can mean penalties or gaps in coverage.

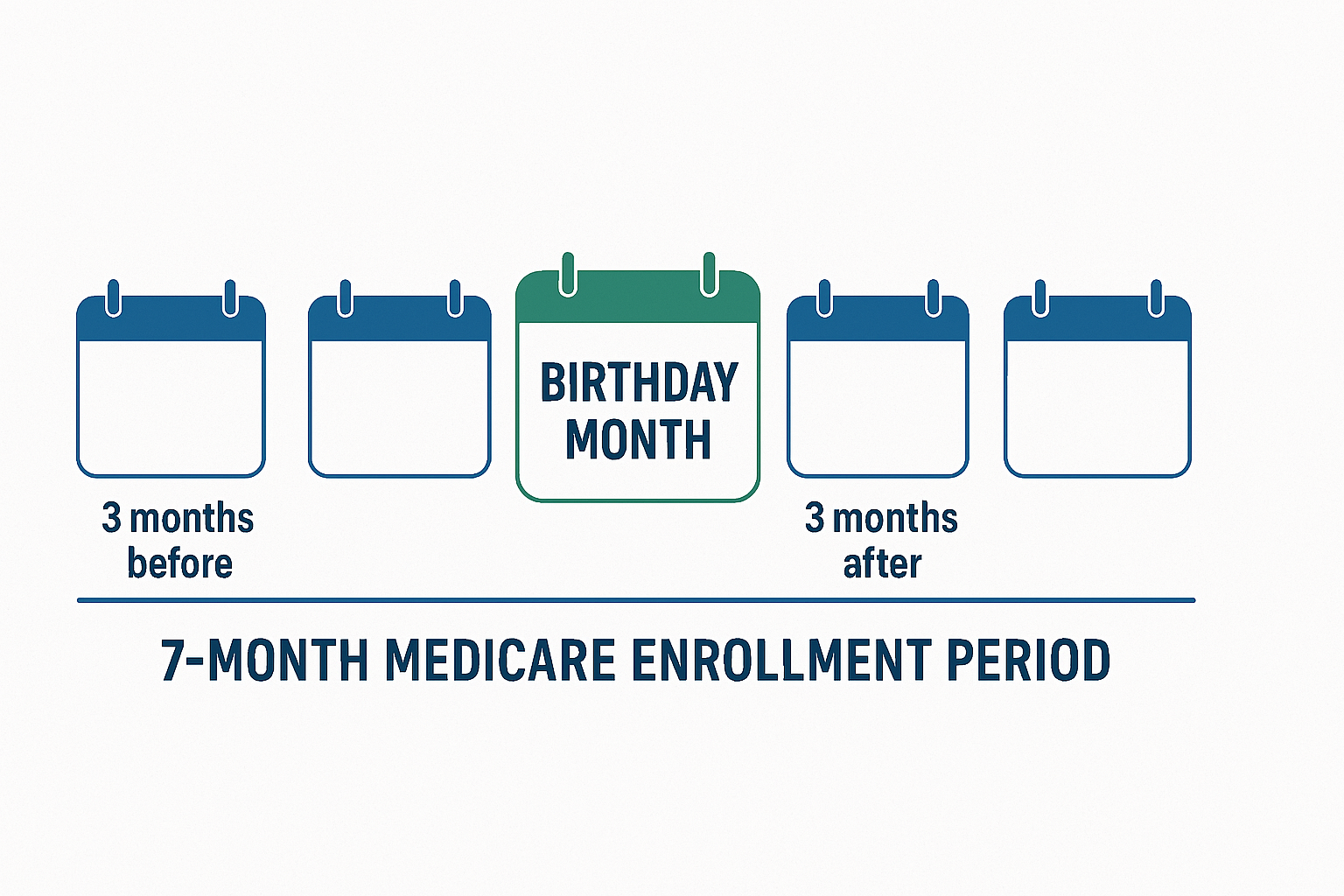

- Initial Enrollment Period (IEP): This is a 7-month window that starts three months before the month you turn 65, includes your birthday month, and ends three months after. During this time, you can sign up for Parts A and B, and add Part D or a Medicare Advantage plan.

- Special Enrollment Period (SEP): If you’re still working and have employer coverage, you may be able to delay enrolling in Part B without penalty. When your employment or coverage ends, you’ll have an 8-month SEP to sign up.

- General Enrollment Period (GEP): If you miss your IEP, you can enroll between January 1 and March 31 each year, but coverage won’t start until July 1, and you may pay a late penalty.

For more on enrollment periods, check out Medicare.gov: When can I sign up for Medicare?

3. Evaluate Your Current Coverage

Are you still working? Do you have retiree health benefits? Are you covered under a spouse’s plan? Your current situation will affect your Medicare choices.

- If you have employer coverage: Talk to your benefits administrator. In many cases, you can delay Part B without penalty if your employer has 20 or more employees.

- If you have retiree coverage: Some retiree plans require you to enroll in Medicare when you turn 65. Failing to do so could mean losing your retiree benefits.

- If you have no other coverage: You’ll want to enroll in Medicare during your IEP to avoid penalties and gaps.

The Medicare & You Handbook is a free, official resource that explains how Medicare works with other insurance.

4. Decide Between Original Medicare and Medicare Advantage

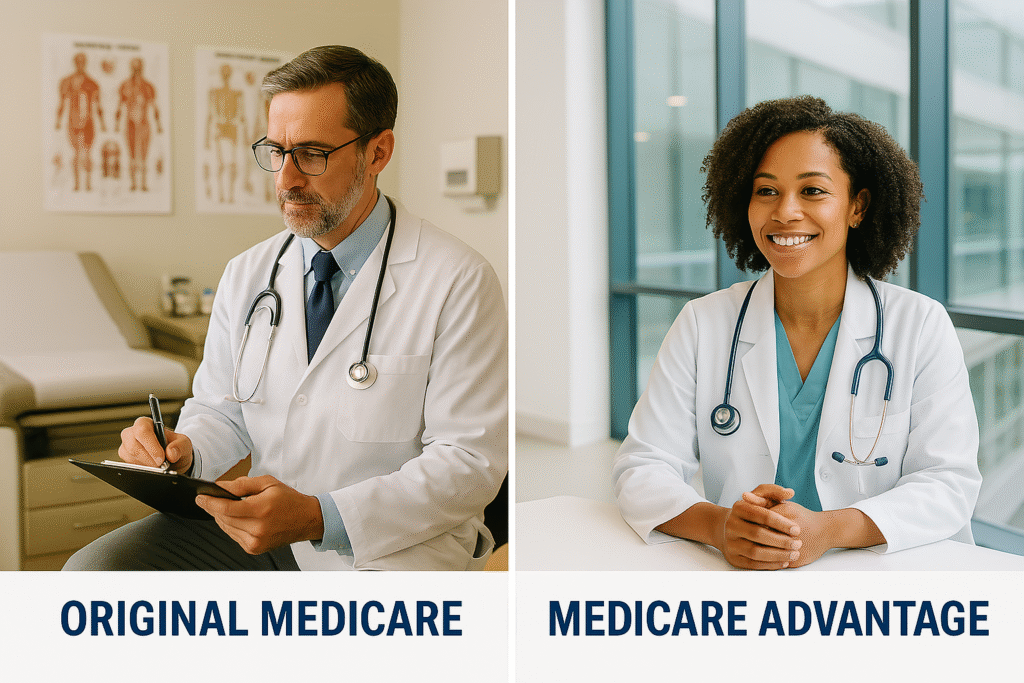

You have two main paths for your Medicare coverage:

- Original Medicare (Parts A & B): You can see any doctor or hospital that accepts Medicare. You can add a standalone Part D plan for prescription drugs and a Medigap (Medicare Supplement) policy to help with out-of-pocket costs.

- Medicare Advantage (Part C): These plans are offered by private insurers and often include drug coverage and extra benefits. You’ll typically use a network of providers.

Each option has pros and cons. Consider your health needs, budget, and preferred doctors. For a side-by-side comparison, visit Medicare.gov: Your Medicare coverage choices.

5. Don’t Forget Prescription Drug Coverage (Part D)

Even if you don’t take many medications now, it’s wise to consider enrolling in a Part D plan when you’re first eligible. If you go without creditable drug coverage for 63 days or more, you may pay a late enrollment penalty if you sign up later.

Use the Medicare Plan Finder to compare drug plans in your area.

6. Consider a Medigap Policy

Original Medicare doesn’t cover everything. You’re responsible for deductibles, coinsurance, and copayments. A Medigap (Medicare Supplement) policy can help cover these costs. You have a 6-month Medigap Open Enrollment Period that starts when you’re both 65 and enrolled in Part B. During this time, you can buy any Medigap policy sold in your state, even if you have health problems.

Learn more at Medicare.gov: Medigap (Medicare Supplement Insurance).

7. Get Free, Unbiased Help

Medicare can be confusing, but you don’t have to figure it out alone. There are free resources to help you:

- State Health Insurance Assistance Program (SHIP): Get personalized counseling from trained volunteers. Find your local SHIP at SHIP Help.

- Medicare.gov: The official site has tools, guides, and live chat support. Start at Medicare.gov.

- Social Security Administration: For questions about enrolling in Medicare, visit ssa.gov/benefits/medicare/ or call 1-800-772-1213.

8. Watch Out for Scams

Unfortunately, scammers target new Medicare enrollees. Remember, Medicare will never call you to ask for your personal information or sell you anything. Protect your Medicare number like a credit card, and report suspicious calls to 1-800-MEDICARE.

9. Review Your Coverage Every Year

Your health needs and plan options can change. Each fall, during Medicare’s Open Enrollment (October 15 – December 7), review your coverage and compare plans. You can switch plans if you find one that better fits your needs.

10. Take Action Early

Don’t wait until the last minute! Start researching your options at least three months before your 65th birthday. This gives you time to ask questions, compare plans, and enroll without stress.

In Summary

Turning 65 and enrolling in Medicare is a big step, but you don’t have to do it alone. By understanding your options, knowing your deadlines, and using free resources, you can make smart choices for your health and your future.

If you have questions or want personalized help, reach out to a licensed Medicare insurance agent or your local SHIP office. And remember, the official Medicare.gov website is always a trustworthy place to start.

Here’s to a healthy, happy, and well-covered future!